Benefits of Getting a Rental Car When in a New City

Exploring a new city is an exciting adventure, but finding the right way to get around can make or break the experience. While public transport is often an option, it doesn’t always offer the flexibility, convenience, and privacy that a rental car provides. One way to solve such issues is to Rent a Car Beograd. This option offers numerous advantages that can enhance your travel experience, making it easier to explore a new city on your own schedule. Here’s a look at some of the key benefits of getting a rental car in a new city.

Freedom to Explore at Your Own Pace

One of the biggest advantages of renting a car is the freedom it offers. Unlike public transport or guided tours, which follow specific schedules, a rental car allows you to create your own itinerary and travel at your own pace. If you find an interesting neighborhood, a scenic view, or a hidden restaurant, you can stop, explore, and continue whenever you’re ready. This flexibility is invaluable in a new city where attractions can be spread out, and public transport schedules may be restrictive. For example, in cities like Los Angeles or Dubai, where top attractions are spread over large areas, a rental car lets you move easily from one point of interest to another without being tied to bus or train schedules.

Convenience for Carrying Luggage and Personal Belongings

Traveling with luggage, shopping bags, or personal belongings can be cumbersome on public transportation. A rental car provides a secure space for your belongings, allowing you to bring along anything you might need for the day without worry. Whether carrying souvenirs, extra clothing, or camera equipment, having a car gives you the storage space you need. This convenience is particularly beneficial if you’re traveling with children or have special items, such as sports equipment, that would be difficult to carry on public transport.

Enhanced Comfort and Privacy

A rental automobile provides luxury and privacy that public transit cannot equal. In a rental car, you may control the temperature, listen to your favorite tracks, and enjoy peaceful moments away from the rush and bustle of packed buses and trains. This is especially useful if you spend a lot of time visiting the city, as a private vehicle gives a pleasant respite between tourist stops. Additionally, privacy can be particularly valuable when traveling with family or friends, as it allows for a more relaxed atmosphere where you can chat and enjoy each other’s company without interruptions.

Increased Safety and Control Over Your Environment

Having your own vehicle provides greater control over your environment and, in many cases, increased safety. Public transport can sometimes be unpredictable, and rideshare services depend on driver availability. With a rental car, you know where your vehicle has been, can control cleanliness, and can rely on the car’s maintenance. Furthermore, being in your own vehicle can add a sense of security if you’re in an unfamiliar area, as you can choose your routes and avoid potentially unsafe areas.

Renting a car when visiting a new city offers unparalleled freedom, convenience, and comfort, allowing you to enjoy your vacation fully. A rental automobile has various perks that enhance the whole trip experience, including exploring secret spots, keeping on schedule, and enjoying solitude and comfort. When planning your next city adventure, consider the convenience and freedom of renting a car to fully immerse yourself in all that the destination has to offer.…

It is important to clearly understand your monthly income and expenses to prevent overspending and ensure that you are not living beyond your means. Creating a budget requires tracking your expenses, analyzing your spending patterns, and identifying areas where you can cut back on unnecessary costs. This process may require some adjustment in your lifestyle, but the long-term benefits of financial stability are worth it. Additionally, sticking to your budget requires discipline and commitment, but it will help you avoid debt and improve your credit score over time.

It is important to clearly understand your monthly income and expenses to prevent overspending and ensure that you are not living beyond your means. Creating a budget requires tracking your expenses, analyzing your spending patterns, and identifying areas where you can cut back on unnecessary costs. This process may require some adjustment in your lifestyle, but the long-term benefits of financial stability are worth it. Additionally, sticking to your budget requires discipline and commitment, but it will help you avoid debt and improve your credit score over time.

Disputing errors on your credit report can significantly impact your credit score. It’s essential to regularly check your credit report to ensure that all the information is accurate, as even small errors can harm your score. The Fair Credit Reporting Act (FCRA) gives you the right to dispute any inaccurate information on your credit report. If you find an error, you should contact the credit reporting agency and provide evidence supporting your dispute. The agency must then investigate the dispute and respond within 30 days. If the agency cannot verify the disputed information, they must remove it from your credit report.

Disputing errors on your credit report can significantly impact your credit score. It’s essential to regularly check your credit report to ensure that all the information is accurate, as even small errors can harm your score. The Fair Credit Reporting Act (FCRA) gives you the right to dispute any inaccurate information on your credit report. If you find an error, you should contact the credit reporting agency and provide evidence supporting your dispute. The agency must then investigate the dispute and respond within 30 days. If the agency cannot verify the disputed information, they must remove it from your credit report.

Finally, if you don’t have the time or resources to manage your social media accounts, then it may be worth considering professional help. Managing multiple social media accounts can be a full-time job – and if you’re already spread thin, staying on top of your accounts can be difficult. A professional strategist can take some of the workloads off your hands, freeing up more time for you to focus on growing your business. As you can see, several warning signs indicate your business social media accounts may need professional help.

Finally, if you don’t have the time or resources to manage your social media accounts, then it may be worth considering professional help. Managing multiple social media accounts can be a full-time job – and if you’re already spread thin, staying on top of your accounts can be difficult. A professional strategist can take some of the workloads off your hands, freeing up more time for you to focus on growing your business. As you can see, several warning signs indicate your business social media accounts may need professional help.

Additionally, you want every page of your website to be encrypted with SSL/TLS. This is denoted by the “HTTPS” in the URL, which stands for Hyper Text Transfer Protocol Secure. Any page that doesn’t have this is not secure. Any data entered on that page (including passwords) can be intercepted by third parties. To get SSL/TLS encryption for your website, you will need to purchase an SSL certificate and install it on your web server. Once you have done that, make sure to enable “HTTPS” in your site’s settings and configure your web server to redirect all traffic from the unsecured “HTTPS” URL to the secure one.

Additionally, you want every page of your website to be encrypted with SSL/TLS. This is denoted by the “HTTPS” in the URL, which stands for Hyper Text Transfer Protocol Secure. Any page that doesn’t have this is not secure. Any data entered on that page (including passwords) can be intercepted by third parties. To get SSL/TLS encryption for your website, you will need to purchase an SSL certificate and install it on your web server. Once you have done that, make sure to enable “HTTPS” in your site’s settings and configure your web server to redirect all traffic from the unsecured “HTTPS” URL to the secure one. Don’t want to mess around with code? That’s fine. There are plenty of plugins that can help you secure your website without having to touch a single line of code. Wordfence, Sucuri, and iThemes Security are the most popular WordPress security plugins. These plugins offer features like malware scanning and removal, firewalls, intrusion detection and prevention, and much more.

Don’t want to mess around with code? That’s fine. There are plenty of plugins that can help you secure your website without having to touch a single line of code. Wordfence, Sucuri, and iThemes Security are the most popular WordPress security plugins. These plugins offer features like malware scanning and removal, firewalls, intrusion detection and prevention, and much more.

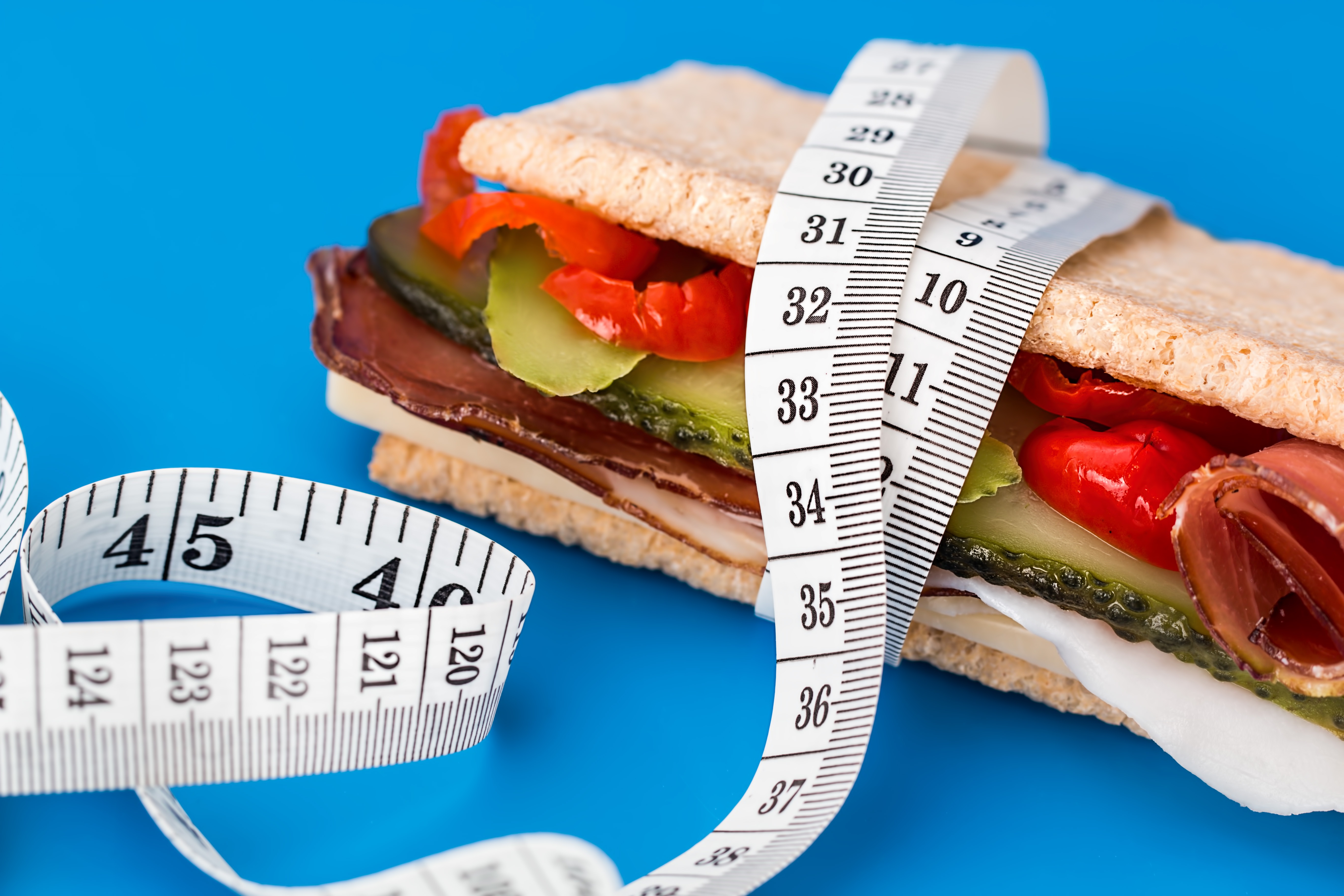

Exercise is an important part of any weight loss program. Not only does it burn calories, but it also helps to build muscle mass. Muscle tissue burns more calories than fat tissue, so the more muscle you have, the more calories you’ll burn at rest. In addition, exercise can help to reduce stress levels and improve your overall health.

Exercise is an important part of any weight loss program. Not only does it burn calories, but it also helps to build muscle mass. Muscle tissue burns more calories than fat tissue, so the more muscle you have, the more calories you’ll burn at rest. In addition, exercise can help to reduce stress levels and improve your overall health.

The other step in developing a strategy to get out of debt is gathering your financial data. This includes your income, expenses, debts, and assets. Once you have this information, you can develop a plan of action. If you’re unsure where to start, many resources are available online and in libraries that can help you gather this information. One thing to remember as you’re gathering your data is that it’s essential, to be honest with yourself. This is not the time to try to hide anything or downplay your debts. The more accurate your information is, the better equipped you’ll be to develop a realistic and effective plan.

The other step in developing a strategy to get out of debt is gathering your financial data. This includes your income, expenses, debts, and assets. Once you have this information, you can develop a plan of action. If you’re unsure where to start, many resources are available online and in libraries that can help you gather this information. One thing to remember as you’re gathering your data is that it’s essential, to be honest with yourself. This is not the time to try to hide anything or downplay your debts. The more accurate your information is, the better equipped you’ll be to develop a realistic and effective plan. Another step to getting out of debt is cutting your unnecessary spending. This may mean making some difficult choices, but it will be worth it in the long run. You’ll need to closely examine your budget and figure out where you can cut back. It may be tough at first, but you can do it. One way to cut your spending is to determine your priorities. What do you need to live comfortably? Once you know your priorities, you can start cutting back on the things that aren’t as important.

Another step to getting out of debt is cutting your unnecessary spending. This may mean making some difficult choices, but it will be worth it in the long run. You’ll need to closely examine your budget and figure out where you can cut back. It may be tough at first, but you can do it. One way to cut your spending is to determine your priorities. What do you need to live comfortably? Once you know your priorities, you can start cutting back on the things that aren’t as important.

Another small habit that can lead to financial freedom is avoiding consumer debt. It includes things like credit card debt, car loans, and other types of debt that are not considered “good” debt. Good debt is typically used to purchase something that will appreciate in value over time, such as a home or an investment property. On the other hand, consumer debt is typically used to purchase items that depreciate in value over time, such as a new car or a designer purse. Not only does this type of debt put a strain on your finances, but it can also be challenging to get out of once you’re in it.

Another small habit that can lead to financial freedom is avoiding consumer debt. It includes things like credit card debt, car loans, and other types of debt that are not considered “good” debt. Good debt is typically used to purchase something that will appreciate in value over time, such as a home or an investment property. On the other hand, consumer debt is typically used to purchase items that depreciate in value over time, such as a new car or a designer purse. Not only does this type of debt put a strain on your finances, but it can also be challenging to get out of once you’re in it. The “fear of missing out” is real, and it can be incredibly tempting in fashion. It’s easy to get caught up in the latest trends, but the truth is that you don’t need to have the latest and greatest of everything. In fact, most of the time, it’s better to stick with classic pieces that you can wear for years to come. Not only will this save you money, but it will also help you build a timeless wardrobe.

The “fear of missing out” is real, and it can be incredibly tempting in fashion. It’s easy to get caught up in the latest trends, but the truth is that you don’t need to have the latest and greatest of everything. In fact, most of the time, it’s better to stick with classic pieces that you can wear for years to come. Not only will this save you money, but it will also help you build a timeless wardrobe.

One of the reasons online therapy is growing in popularity is its convenience. You can log into your sessions from anywhere, at any time. All you need is a computer or smartphone and an internet connection.

One of the reasons online therapy is growing in popularity is its convenience. You can log into your sessions from anywhere, at any time. All you need is a computer or smartphone and an internet connection. Online therapy can treat a variety of mental health issues, including depression, anxiety, and addiction. Unfortunately, the number of people suffering from various mental health issues is rising.

Online therapy can treat a variety of mental health issues, including depression, anxiety, and addiction. Unfortunately, the number of people suffering from various mental health issues is rising.

A traditional life policy is a permanent life insurance plan that guarantees the death benefit for as long as you live. With this type of coverage, premiums are fixed and do not change throughout your life — even if health conditions deteriorate over time. Other benefits include tax-deferred cash value accumulation (savings grow without being taxed) and a guaranteed interest rate. If you want a permanent life insurance plan with a fixed premium, whole traditional life is a good option. Keep in mind that you may not increase the death benefit if your health declines later on in life.

A traditional life policy is a permanent life insurance plan that guarantees the death benefit for as long as you live. With this type of coverage, premiums are fixed and do not change throughout your life — even if health conditions deteriorate over time. Other benefits include tax-deferred cash value accumulation (savings grow without being taxed) and a guaranteed interest rate. If you want a permanent life insurance plan with a fixed premium, whole traditional life is a good option. Keep in mind that you may not increase the death benefit if your health declines later on in life. A variable life insurance policy is a permanent plan that allows you to invest in different funds (e.g., stocks, bonds, mutual funds). This means your policy’s cash value will vary depending on how the investments perform. If you are comfortable with taking on more risk, a variable life insurance policy could be a good option for you.

A variable life insurance policy is a permanent plan that allows you to invest in different funds (e.g., stocks, bonds, mutual funds). This means your policy’s cash value will vary depending on how the investments perform. If you are comfortable with taking on more risk, a variable life insurance policy could be a good option for you.

You should ensure that you find out more about the reputation of an online steroid store before you buy from them. Find out what the people who have purchased from a store think about their service and quality of products. Read some reviews online to be able to make your decision easier on where you want to invest in steroids. As the fitness industry is largely impacted by the internet these days, many websites offer people a platform to write reviews about the online stores they have bought from.

You should ensure that you find out more about the reputation of an online steroid store before you buy from them. Find out what the people who have purchased from a store think about their service and quality of products. Read some reviews online to be able to make your decision easier on where you want to invest in steroids. As the fitness industry is largely impacted by the internet these days, many websites offer people a platform to write reviews about the online stores they have bought from. The last consideration you should make when choosing an online steroid retailer is the pricing. You should consider if their prices are competitive and fair, or not. If they seem to be very low compared to others that sell similar products, you may want to look elsewhere because it could mean that the products are of poor quality. This can pose a risk as you might end up buying something that will give you severe side effects. It is also important to consider the payment methods available.

The last consideration you should make when choosing an online steroid retailer is the pricing. You should consider if their prices are competitive and fair, or not. If they seem to be very low compared to others that sell similar products, you may want to look elsewhere because it could mean that the products are of poor quality. This can pose a risk as you might end up buying something that will give you severe side effects. It is also important to consider the payment methods available.

The third consideration you should make when protecting yourself from identity theft is to create strong passwords. The goal of a password should be to make it difficult for someone else to guess or crack your password, but still simple enough that you can remember the password because you will need it often.There are many different ways one can go about creating secure passwords. One option would be using passphrases instead of single-word phrases as your passwords.

The third consideration you should make when protecting yourself from identity theft is to create strong passwords. The goal of a password should be to make it difficult for someone else to guess or crack your password, but still simple enough that you can remember the password because you will need it often.There are many different ways one can go about creating secure passwords. One option would be using passphrases instead of single-word phrases as your passwords.

It is crucial to understand that everyone loves cocktails. That is why one of the best things you can do for your friend is organizing them a cocktail party on this particular day. Make sure you buy the ingredients ahead of time and plan the event successfully.

It is crucial to understand that everyone loves cocktails. That is why one of the best things you can do for your friend is organizing them a cocktail party on this particular day. Make sure you buy the ingredients ahead of time and plan the event successfully. Another thing you need to do on this special day is to make some sweet and memorable treats. Therefore, you need to ensure you are more creative in the kitchen and a mouth washing recipe. With a delicious meal, you will appreciate your friend on this day, and it will remain a memorable one.

Another thing you need to do on this special day is to make some sweet and memorable treats. Therefore, you need to ensure you are more creative in the kitchen and a mouth washing recipe. With a delicious meal, you will appreciate your friend on this day, and it will remain a memorable one.

As a pet owner, you have experienced anxiety in your dog and other pets. Stress is caused mainly by separation, fear, confinement in movement, and aging. Besides, you could have tried several pharmaceutical methods to calm your pet’s nerves in vain. CBD oil for anxiety in dogs interacts with the endocannabinoid receptors present in your pet’s peripheral and central nervous system. Ideally

As a pet owner, you have experienced anxiety in your dog and other pets. Stress is caused mainly by separation, fear, confinement in movement, and aging. Besides, you could have tried several pharmaceutical methods to calm your pet’s nerves in vain. CBD oil for anxiety in dogs interacts with the endocannabinoid receptors present in your pet’s peripheral and central nervous system. Ideally  Lastly, pets that lack appetite due to diseases or drugs can use CBD oil to increase their desire. Hence, it is known for reducing nausea, vomiting and improving appetite. Furthermore, studies have shown that hep oil reduces high blood pressure enabling your pet to have a healthy heartbeat rate. CBD oil also does not contain fatty acids, making it ideal for relieving stress in dogs. However, if you are not sure about CBD oil, it is advisable to contact your vet for recommendations.…

Lastly, pets that lack appetite due to diseases or drugs can use CBD oil to increase their desire. Hence, it is known for reducing nausea, vomiting and improving appetite. Furthermore, studies have shown that hep oil reduces high blood pressure enabling your pet to have a healthy heartbeat rate. CBD oil also does not contain fatty acids, making it ideal for relieving stress in dogs. However, if you are not sure about CBD oil, it is advisable to contact your vet for recommendations.…

Kegels are the perfect way to give you a strong pelvic floor. Kegels will help in tightening your pelvic muscles and help you hold urine in your bladder for a longer time. Pelvic floor exercises are a perfect treatment for urinary incontinence in women. You can do Kegel exercises in the comfort of your home where you lie down and relax your body.

Kegels are the perfect way to give you a strong pelvic floor. Kegels will help in tightening your pelvic muscles and help you hold urine in your bladder for a longer time. Pelvic floor exercises are a perfect treatment for urinary incontinence in women. You can do Kegel exercises in the comfort of your home where you lie down and relax your body.

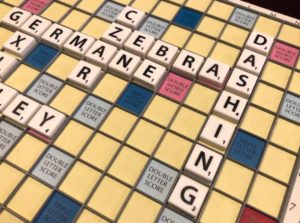

of the game, put all the letter tiles in a bag and lay out the playing field. To determine the right of the first move, each participant will pull out a letter from the bag: the first will be the one whose letter is closer to the alphabet’s beginning. The drawn tokens are returned to the bag, and after each one is given seven new tokens.

of the game, put all the letter tiles in a bag and lay out the playing field. To determine the right of the first move, each participant will pull out a letter from the bag: the first will be the one whose letter is closer to the alphabet’s beginning. The drawn tokens are returned to the bag, and after each one is given seven new tokens. players are advised to learn rare words to increase the chances of winning. Also, beginners are advised to learn as many three and two-letter words as possible. It is helpful for players to save space for possible placement of large words and to keep the grid of letters in harmony (between consonants and vowels). The secret to the success of many players is that they place letters with high points on multi-colored sectors that double the points.

players are advised to learn rare words to increase the chances of winning. Also, beginners are advised to learn as many three and two-letter words as possible. It is helpful for players to save space for possible placement of large words and to keep the grid of letters in harmony (between consonants and vowels). The secret to the success of many players is that they place letters with high points on multi-colored sectors that double the points.

One of the significant reasons for making online dispensaries a good option is because they are hassle-free and convenient to the customers. When you have a workable device and an internet connection, you can purchase anywhere and anytime. Thus you will not need to re-arrange your busy schedule to make a trip to the physical dispensaries, especially when you live far from them. Online dispensaries can help consumers who suffer from chronic pain or other ailments which make it hard for them to move

One of the significant reasons for making online dispensaries a good option is because they are hassle-free and convenient to the customers. When you have a workable device and an internet connection, you can purchase anywhere and anytime. Thus you will not need to re-arrange your busy schedule to make a trip to the physical dispensaries, especially when you live far from them. Online dispensaries can help consumers who suffer from chronic pain or other ailments which make it hard for them to move

end up turning into debt bondage, you need not only to adequately measure your financial capabilities but also to understand the nuances of loan products and follow the advice of experts. Consider the main criteria for competent lending.

end up turning into debt bondage, you need not only to adequately measure your financial capabilities but also to understand the nuances of loan products and follow the advice of experts. Consider the main criteria for competent lending. The social platforms help supplement the company’s website and even the physical shop if there is one. These communication channels can reach various audiences in a very personal and entertaining way. As such, businesses can use them to make those who do not know about the company to check it and do business with it.

The social platforms help supplement the company’s website and even the physical shop if there is one. These communication channels can reach various audiences in a very personal and entertaining way. As such, businesses can use them to make those who do not know about the company to check it and do business with it. The past means of communication, such as the snail mails and suggestion boxes, were slow for customers to pass their message to businesses. It would take several days before the right persons got the message and responded. Fortunately, social platforms allow customers to communicate with customer representatives faster and efficiently.

The past means of communication, such as the snail mails and suggestion boxes, were slow for customers to pass their message to businesses. It would take several days before the right persons got the message and responded. Fortunately, social platforms allow customers to communicate with customer representatives faster and efficiently.

The business should, from the start, hire a competent lawyer or law firm. The attorney will advise the owners and management before they take any action, and if the company has been sued, recommend to them the steps to take. Ideally, the lawyer should be familiar with the state’s laws where the business operates. They should also be well equipped in the critical areas on which the company could need legal counsel, for example, tax and employee relations.

The business should, from the start, hire a competent lawyer or law firm. The attorney will advise the owners and management before they take any action, and if the company has been sued, recommend to them the steps to take. Ideally, the lawyer should be familiar with the state’s laws where the business operates. They should also be well equipped in the critical areas on which the company could need legal counsel, for example, tax and employee relations.

People, you think about business registration start with a unique name. This is an important step so that your business can stand out from the rest. Your name is your trademark, and it is the identity that will differentiate your business from the rest.

People, you think about business registration start with a unique name. This is an important step so that your business can stand out from the rest. Your name is your trademark, and it is the identity that will differentiate your business from the rest. Some businesses to require licenses and permits. For instance, if you plan to start a dental clinic, you need to get licenses and permits from the necessary bodies.

Some businesses to require licenses and permits. For instance, if you plan to start a dental clinic, you need to get licenses and permits from the necessary bodies.

Limited liability companies or incorporated businesses are deemed to be more credible than sole proprietorships. After adding the name LLC or Inc to a business name, the sales may grow because they may perceive the venture as more reliable.

Limited liability companies or incorporated businesses are deemed to be more credible than sole proprietorships. After adding the name LLC or Inc to a business name, the sales may grow because they may perceive the venture as more reliable. The fact that the owners of LLCs are held liable for business debts up to the extent of their investment in the business is one of the main advantages of incorporating, especially for small businesses. If you run a venture alone, you are at a higher risk of losing your assets due to the business’s debts. You are also answerable for all the business legal suits, and you could find yourself bearing hefty fines and penalties that can bring you down.

The fact that the owners of LLCs are held liable for business debts up to the extent of their investment in the business is one of the main advantages of incorporating, especially for small businesses. If you run a venture alone, you are at a higher risk of losing your assets due to the business’s debts. You are also answerable for all the business legal suits, and you could find yourself bearing hefty fines and penalties that can bring you down.

If you are an executive, not married, and prefer to live alone, buying a landed house seems to be too much for your standards. What you need is a compact unit with luxurious designs to support your modern lifestyle. For that reason, buying a condo unit is exactly what you need, and Empire Quay House can give you what you need and want. Several unit options are available, and each unit is designed to meet certain standards and needs. Options, such as one-bedroom, two-bedroom, and three-bedroom suites, are available to ensure your comfort.

If you are an executive, not married, and prefer to live alone, buying a landed house seems to be too much for your standards. What you need is a compact unit with luxurious designs to support your modern lifestyle. For that reason, buying a condo unit is exactly what you need, and Empire Quay House can give you what you need and want. Several unit options are available, and each unit is designed to meet certain standards and needs. Options, such as one-bedroom, two-bedroom, and three-bedroom suites, are available to ensure your comfort.

Oatmeal is one of the most popular healthy breakfast staples around the world, and it has come back in

Oatmeal is one of the most popular healthy breakfast staples around the world, and it has come back in  Chia seed puddings are probably one of the healthiest and tastiest choices when it comes to breakfast, at least that is what I think. To make chia seed pudding, all you have to do is mix

Chia seed puddings are probably one of the healthiest and tastiest choices when it comes to breakfast, at least that is what I think. To make chia seed pudding, all you have to do is mix

Denim has been a staple in everyone’s wardrobe since forever. It has been one of the things that people have been using for casual and relaxed events.

Denim has been a staple in everyone’s wardrobe since forever. It has been one of the things that people have been using for casual and relaxed events. Statement accessories have always been a trend each year by year. However, in the year 2018, accessories no longer just mean jewelry.

Statement accessories have always been a trend each year by year. However, in the year 2018, accessories no longer just mean jewelry. We have seen this trends on celebrities as well as the runways for quite a while now.

We have seen this trends on celebrities as well as the runways for quite a while now.